Tesla vs Berkshire? Vs Something Else?

I was recently discussing the sustainability of business models with a dear friend of mine who's also a very smart businessman. he said to me something along the lines of...

I'd not want to be Tesla even though it seems much more profitable today. But it's a very new company and we don't know what could potentially happen to it over the long term. I'd much rather be Berkshire Hathaway that has been profitable as well as having lasted over sixty years now.

The point we were discussing was based on debt, and how debt can, should and ought to be used. This discussion came about at the heels of $BTC and $CEL (Celsius Network Token) crashing in values within weeks. Where $BTC crashed from $70,000 roughly all the way to $33,000, the $CEL token crashed from an all-time high of $8.05 in June 2021 to about $2 in January 2022.

This led to a large number of margin calls whereby people who had borrowed money against collateralized crypto-assets were forced to either deposit additional cryptocurrency or repay their loans immediately lest they wished to be liquidated.

Debt is often thought to be a great growth catalyst especially in hyperinflationary economic environments such as the one we now live in. Debt is cheap, readily available, and over the decades, the underlying collateral is bound to go up in value so long as you collateralize the right assets. And if deployed correctly, debt can double, or even triple the rate of return you receive on your investments.

Let's take an example...

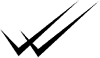

So this is a rudimentary analysis of two possible methods of acquiring a particular piece of real estate (in this case in the state of Ohio) with the express purpose of renting it out using a management company that charges a fee but manages everything from maintenance to finding tenants to minimizing vacancy and so on.

Without debt, all cash down

The first method of acquiring this property (priced at $63,135 including closing costs) would be to bring $63,135 all-cash to the deal. You'd pay the seller and pay the closing costs, and the property is yours. No debt, no mortgage payments, nothing to worry about.

Fixed Expenses

I said you'd have nothing to worry about. Well... I mean nothing but the regular ongoing costs such as property taxes ($932.00 per year), insurance (estimated at $600.00 per year) and maintenance (about $444.00 per year). These costs are associated with owning this property outright, and you'd pay the amount of roughly $1,976.00 per year or about $165.00 a month to maintain the property in good order.

Variable Expenses

Now, based on comparable rentals in the neighborhood, you could rent this property out for $925.00 a month. Of course, you'd account for some vacancy (in my estimate 3% of the time) and if you're like me you'd also pay someone to manage it all for you so it's basically hands-off for you, so they'd charge you a 10% management fee.

The Returns

After all those expenses, you'd be left with $640.08 a month, or $7,681 a year. On your initial investment of $63,135.00, this is a return rate of 12.17% in cash.

Using Debt, only 20% cash down

The second scenario is the method most people like to use. The method of paying down just 20% of the total cost of acquisition, also known as 4:1 leverage. So for every $1 you put down, a bank (or a mortgage lender or a private lender or some other financier) puts down $4. In return you pay them an interest, and you repay the borrowed capital over a period of ten, fifteen, twenty or thirty years.

While your fixed costs and variable costs of owning and renting this property remain the same, you also pay $262.06 every month to the lender in this case, who's charging you 5% a year for the money they lent to you. This brings your net cashflow per month down to $378.03 from $640.08 that you'd take home if you didn't use leverage.

Why is debt lucrative?

- Lower barrier to entry. Instead of putting up $63,135.00, you only need to bring $14,335.00 to the table.

- A significantly higher rate of return on your money. So while you're making less money ($378.03 instead of $640.08 a month) you're still making a much higher rate of return on your money... 31.65% instead of 12.17%... simply because you put up a lot less capital to begin with.

- Much higher capital growth rate. Say this property grows at 2% per year over the next ten years. If you never used debt, your capital would grow at 2% per year. But if you did use debt, not only would you have repaid a portion of the debt you obtained, you'd also receive capital gains on the entire $63,135.00 invested and not just the $14,335.00 that you put out. As a result, your capital gain could be as high as 8% to 10% (annualized) or even more. this is on top of the cash-on-cash return we talked about earlier..

Given all that, it may sound like I am actually in love with the idea of using debt to such an extent that I am promoting it to you. Right? Wrong!

Here's Why You Shouldn't Use Debt

Please note that this article is an editorial, an opinion piece rather than financial advice. Please treat it accordingly. I do not know what your portfolio looks like, and/or what is best for you. With that said, I am rather confident about not using debt for my own portfolio, and here are the reasons why I avoid debt like the plague...

1. Your fixed expenses go up massively

In this example above, if you did not have debt, your fixed expenses associated with owning this property were limited to just $165.00 a month. Of course, if you rented it out, you'd have some additional costs, but those were variable costs anyway. You wouldn't pay a management fee if there were no tenants to manage. Nor would you deduct a vacancy, Your fixed costs were as little as $165.00 a month, and that's that.

Whereas with debt, your fixed expenses go up by $262.06 a month. This brings your liability up by almost 159%. From $165.00 a month all the way to $427.06 a month.

Keep in mind that these are fixed expenses. Regardless of whether or not you have tenants, you'd be on the hook for $427.06 a month instead of $165.00 a month.

In percentage terms, it's even worse. $165.00 a month is just 0.26% of $63,135 a month (which would be your initial investment). But if you used leverage, you'd buy five such houses, and you'd be on the hook for $2135.30 a month on your $63,135. Which is 3.38% a month. That's 40.58% a year. Compared to just 3.12% a year without leverage.

Variable expenses don't worry me. They grow in tandem with revenues. So they're easy to take care of. It's the fixed expenses that worry me. Fixed expenses are what spell the doom. Fixed expenses are what drown you. They're what kill you.

2. Murphy's Law

Remember, every coin has two sides.

While debt is great for growth, you must consider the worst case scenario. The worst case scenario is that the markets turn. And when they do, you can't find tenants. And so you're on the hook for 40.58% a year.

While it may seem like an unlikely scenario, the fact remains, improbable is not the same as impossible. In fact, regardless of how improbable something might be, the world is always in such an enormous flux that Murphy's law (whatever can happen will happen eventually) comes into play.

Take, for instance, the gambler who bets that since the odds of having zeroes on three consecutive roulette turns are so low (2/38^3=3.65*10^-5 or 3.65 in 100,000 chances) it'll probably never happen. And so this gambler bets on both odds and evens continually, incrementally betting everytime the roulette ball sits on a zero.

And while he is right most of the time, one day, it just so happens that the low probability event does come to fruition. The roulette ball lands on a zero four consecutive times, and our hero gets wiped out.

This is not only not improbable, but it happens so frequently that the casino banks on it to an extent that they'll let you win for days, weeks, months in a row, because they know one day Murphy's law will destroy you.

And casino wins in the end. Almost every single time.

The same thing happens to your investment portfolios. When the markets are down, they are down. Not only can you not find renters for your property, the appraised value of your property crashes. Because you're not the only one for whom the market went into a glut. There are tons of other investors who're also getting crushed under their fixed monthly payments and yet can't find a tenant. Sooner or later, they all try to sell off the property to pay off their outstanding debts as servicing those debts gets increasingly tedious and neigh unviable. And you know what happens when everyone's selling an asset that doesn't produce a return like it used to.

The prices crash. You may have to sell your property and still be on the line to pay back the remainder of the outstanding debt.

Whereas the guy who outright owns his one silly little property needs to find a month-to-month tenant who'll pay just $200.00 a month. Which shouldn't be very hard given that this property was recently renting for $925.00 a month. This investor just needs to bide his time until the markets turn again. If he's smart, he's saved up to scoop another property like this one, which now only costs $40,000 because of the bloodbath that took place in the market as everyone got liquidated.

3. Lower Returns Aren't A Problem At All

So long as your expenses are taken care of, and you're living a life you enjoy, a higher rate of return does nothing but put a larger number on your screen. That's it. There's nothing else to it.

If you're cashflow positive without debt... if your expenses are well taken care of and you still have plenty left over to save or invest in other assets, a 12% return is fine, and a 30% makes no difference whatsoever.

I'd venture on to argue that the extra 20% you make actually costs you more in terms of the added stress and fear of markets turning, which experience has showed us is a matter of 'when' not 'if'.

You can sleep easy making 12% or you could stay up at night while making 30%. The choice is entirely yours.

Personally, I have no use for the stress and constant anxiety accrued by living under the fear of lending overlords. The goal is to make my money work for me, not the other way around.

I'd rather outright own my home instead of renting it or having a mortgage, even if it doesn't look like a sound financial decision. Why? Because debt kills. The monthly payments kill.

If you don't believe me, ask Fairway NYC. That link takes you to an excellent article on what happens when debt-fueled growth comes into play in the context of a highly profitable, long-standing, customer-favored business. Though you should read the entire article for yourself, here are some choice excerpts from the article...

The story is a familiar one, even for shoppers hundreds of miles from the nearest Fairway. Most consumers have seen some of their favorite chains—Toys “R” Us, Shopko, Claire’s, Payless ShoeSource, Nine West, Gymboree, Staples, and A&P, among many others—face financial distress and shutter some or all of their stores. Like Fairway, these businesses were owned by private equity, a form of finance in which investors buy, overhaul, and then sell companies. Also like Fairway, the other retail chains were profitable at the time they were taken over. Before those buyouts, these businesses had low debt levels and owned their real estate—a necessary precaution for companies suddenly facing more competition or industries seeing widespread changes.

All these formerly glorious companies were both profitable, as well as had low levels of debt and owned their real estate. Do you see a correlation here like I do? And what happens when private equity (smart money) takes over?

The motivation is very different for private-equity owners, who operate under a shorter time frame, often just three to five years, before moving on. For them, low levels of debt and high levels of real-estate ownership present a get-rich-quick opportunity.

The low debt means that private-equity firms can acquire retail chains by putting up very little of their own money and can take on high levels of debt that the company, not the investors who own it, must ultimately repay. The real estate gives investors an opportunity to sell off some of it and pocket the proceeds, leaving the stores to pay rent on properties they once owned. Especially attractive to private-equity owners is the high cash flow in retail operations. Private-equity owners have not been shy about putting their hands in the till to pay themselves exorbitant dividends.

So basically, private equity either increases the debt-load, or sells of real estate in order to rent it back from the new owners. Often they do both. They use this influx of cash to write themselves nice big checks in bonuses and dividends.

The business, in the meantime, is left with the burden of servicing either debt, or rental expense, often both.

You can read the rest of the details directly here. But here's what eventually happens... inevitably...

What did you expect? What else could possibly have come out of this situation? The times change, and profitability, like every other business, goes down (or up). But while the business somehow survived the onslaught of debt and rent when the profitability was high, all of it came crashing down when profits were no longer enough to service the fixed expenses.

Remember, markets will turn.

If you're very profitable today, you won't always be. And if the profit margins are lean, they won't always be.

So long as you manage to survive, you will continue to experience low tides and high tides of profitability in your business. Regardless of your industry, regardless of the economy, regardless of how brilliant you are. Markets, like tides will turn. They always do.

The One Rule To Abide By

If You Want To Survive 1000 Years

You came here for the one rule to rule them all. And you will not leave empty-handed.

If you wish to survive 1000 years, keep your debt as close to zero as you can. And minimize your fixed expenses by owning real estate instead of renting it.

Do this, and you're likely to survive for however long you wish to remain in business. if you own your real estate and have no debt, monthly overhead gets astonishingly closer to zero than it could be otherwise. Which affords you the luxury of time.

Owning Real Estate And Lowering Debt

Affords You The Luxury of Time.

- Time to wait for the markets to turn.

- Time to rethink your strategy.

- Time to innovate, and out-innovate your competitors.

- Time to be the last man standing while others around you crumble under the weight of fixed expenses they can no longer service.

In the end, I'd like to share with you the case study of businesses that have actually survived 1000 years.

These mochi shops in Japan have stood the test of time. They have not necessarily focused on growth or on being extremely profitable/lucrative business opportunities. They have, instead, focused on surviving. Sustaining that legacy. Being around to live another day while everything else in the world got eroded by the winds of time.

The question you need to ask is what is more important for you... Growth at the expense of inevitable decimation under burdens you can no longer service because of factors beyond your control? Or surviving the worst possible markets without so much as a pang of anxiety?

I know which way I lean. How about you?